When we work with those manufacturers that sell via resellers of various types, we often encounter an instance of the Drunkard’s Search problem within the sales department.

This article describes the problem, as well as a solution we devised around 15 years ago—but abandoned because we believed it was too complex to be practical.

Our interest in the solution was reignited recently when we encountered two clients convinced it was a breakthrough! The first was the Australian organization for which we devised the solution 15 years ago. After our engagement ended they pressed our theoretical solution into service and have benefited from it ever since. The second was a South African organization that lept on this idea when we cautiously mentioned it to them because they concluded it was a perfect fit for their reseller network.

The drunkard’s search

The Drunkard’s Search is a parable that describes a drunk searching for his car keys under a streetlight (because that’s where the light is) rather than near his car, where he lost them! It points to a kind of observational bias where we assume something is meaningful just because it’s visible.

A manufacturer that distributes its products through a channel (a reseller network) is similar to all organizations in that it’s dependent upon revenue for its survival. But where this manufacturer differs from other organizations is that the revenue it banks doesn’t come directly from the end consumers of its products, it comes via one or more (somewhat disinterested) channel partners.

This revenue stream is similar to the ground being examined by the drunkard under the streetlight. It’s very visible but, where short-term decisions are concerned, it’s not particularly meaningful.

If you’re such a manufacturer and you have salespeople within a sales department who are held accountable for this revenue stream (perhaps even compensated based on it), this focus on the visible is likely resulting in some unintended negative consequences.

These negative consequences fall into two categories. There’s the damage done when salespeople stuff the channel with inventory. And then there’s the lost opportunity when salespeople fail to focus on the point in the channel where the ultimate sale (to the end consumer) is occurring.

Moving the streetlight

In theory, the solution to this problem is simple.

In organizations, there’s a strong tendency to measure what’s visible and then to optimize what’s measured. In short, this means that the behavior of employees is heavily influenced by what they can see.

Given this, you can often change behaviors by simply moving the streetlight.

In practice, this means making revenue less visible (by reporting aggregate numbers, or a rolling average calculated over a longer period, for example), and then highlighting a more meaningful metric.

Revenue: first- versus proximate-cause

Our quest for a more meaningful metric starts with revenue but it obviously doesn’t finish there.

Once a distribution channel has reached a steady state, the first cause of revenue is an end consumer making a purchase. The proximate cause is an upstream reseller placing a replenishment order with the manufacturer.

The manufacturer should be focusing most of their attention on the first cause of revenue (which is the final transaction in the chain). Yes, this is counterintuitive!

Now, there’s a natural limit to how much influence the manufacturer can wield over that final transaction. After all, the manufacturer has decided not to sell direct. The best it can do is influence the antecedents to that final transaction: the set of conditions that facilitated the final transaction.

We call that set of conditions the Ideal Condition Set. And, compliance with this Ideal Condition Set is our recommended metric for channel optimization.

The Ideal Condition Set (ICS)

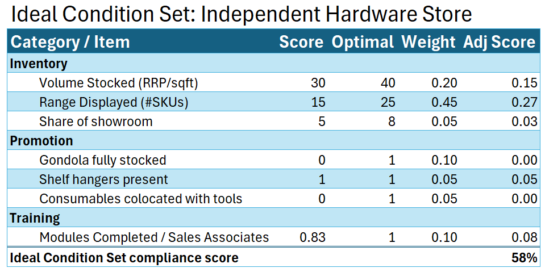

We define the Ideal Condition Set (ICS) as the set of conditions that results in optimal sell-through at the final point of sale.

These conditions typically include things like the range of products stocked, the quality of merchandising, the competence of sales associates, and so on.

To be appropriate, these conditions must impact sell-through, obviously, but they must also be something that your “salespeople” can actually influence and something that can be measured.

If you’re wondering why the word salespeople appears in scare quotes above it’s because the folks who call on channel partners probably shouldn’t be called salespeople, they should be called channel managers.

And rather than selling, in a traditional sense, channel managers should use their persuasiveness to migrate channel partners toward full compliance with the ICS. This means that they should conduct themselves more like retail consultants than traditional salespeople.

As far as the metric is concerned, once you have a set of measurable conditions, all you need do is figure out how to score and weight each condition, and then you can reduce compliance for a channel partner (or a group of them) to a single number (72%, for example).

We argue that this is the number that your sales and marketing departments should be watching (and optimizing for).

If you mute the visibility of the revenue stream and, instead, shine a light on compliance with the ideal condition set, your channel managers will focus on driving sell-through at the final point of sale rather than attempting to convince the first reseller in your distribution chain to buy more inventory.

I think it’s reasonable to assume that this new focus will be good for revenue in the long run.

The mechanics

Finally, here are some pointers on how to turn this idea into a functional framework.

- Segment channel partners into homogeneous groups (if you sell tools, for example, you might arrive at the following segments: big-box hardware stores, independent hardware stores, industrial supply houses, trade supply stores, and so on.

- Within each segment, identify the best-performing channel partners. Visit them and try and determine the critical few factors that drive their success. Reduce this list to the factors your channel managers can reasonably influence. Devise a way to score and weight each of these factors. (KISS!)

- Create a means to record these scores against the Account record in your CRM and a way to catalog evidence of these scores (e.g. a photograph of a point-of-sale display).

- Create a process to update the status of existing accounts (please do not call this an audit!) and to onboard new accounts.

- Sell this new methodology to your team and allow them to contribute ideas and improvements. Deprioritize the existing revenue signal and find a way to prioritize your channel’s ICS compliance number over time (perhaps create a run chart that occupies an entire wall in your office!)

- Monitor the relationship between ICS compliance and revenue (measure it over a sensible time horizon) and confirm that there is a positive correlation between the two numbers (adjust the ICS framework if not)