In most discussions of sales, the greater organization doesn’t rate a mention.

This is more than an idle curiosity. The fact that we traditionally consider the sales function in isolation is likely to be an admission of a fundamental flaw in the design of sales – as well as the cause of many of the problems we experience.

This chapter presents a model for the organization as a whole and exposes the critical connections between sales and the other key organizational functions. We’ll start with the goal of the organization and drill-down to discover what the sales function must do – not to be successful in isolation – but to contribute to the success of the organization as a whole.

* * * *

While this book contains many implicit references to the Theory of Constraints (TOC), this chapter formally introduces some of TOC’s key concepts. TOC is a process-engineering methodology, developed by Eliyahu Goldratt and popularized in his 1984 best-seller The Goal. In short, TOC recognizes that the output of any system is determined by the system’s lowest-capacity resource – and that this resource (the constraint) can be used to gather intelligence about, and exercise control over, the system as a whole.

In practice, TOC enables a decision-making approach that contrasts with the traditional (cost-accounting-based) approach – which assumes (erroneously) that the output of a system is the sum of the output of each of the system resources.

The goal

Considering that this book considers just one type of organization (a business), the goal is obvious: to make money (now, and in the future). And, at a glance, the contribution that sales must make to the achievement of this goal also appears obvious: to make sales.

But, not so fast!

Does it automatically follow that, if the sales function generates more sales, then the organization makes more money?

Actually, it doesn’t. There are two (common) cases where the sales function can actually harm the greater organization by generating more sales.

Sales can sell something that production doesn’t have the ability (or capacity) to produce to the customer’s requirements (damaging goodwill as a consequence).

Sales can sell something that causes the organization to make less money than it otherwise would. (For example, limited production resources might be diverted to fill orders that generate a lower yield on those resources.)

We must recognize, then, that the objective of sales cannot be defined in isolation. It must reference at least one other organizational function. (And the same can be said for each of the other functions.)

We should also suspect that, because organizations can differ significantly from one another, it may not be possible to specify the objective with a standard statement that is applicable in every circumstance.

The constraint

As I’ve mentioned, a business consists of a number of functions that must work together to make money (the goal). How much money the business makes is determined, to a large extent, by how well these functions work together.

Let’s consider a very simple business, consisting of just a sales and a production function.

In order to make money, the business as a whole must generate gross profit at a faster rate than it incurs operating expenses. Units of gross profit must be processed by both sales and production before they can be banked. Specifically, sales must win an order and then production must fulfill it.

We will use the (TOC) term Throughput to refer to units of gross profit. Technically, Throughput is equal to the revenue generated by a transaction, minus the totally-variable costs associated with that transaction (raw material costs, sales commissions, shipping, etc).

Because the amount of money that a business makes is a function of the rate at which it processes Throughput, it is important that we understand the capacity of the business. In other words, we need to know how much Throughput the business can process in a given period.

The capacity of the business as a whole is determined by the capacity of its lowest-capacity function (what we’ll call the constraint).

So, if the capacity of each of the functions in our simple business is as marked above, it should be clear that this business can only generate $10,000 (Throughput) a day. Production does have the capacity to produce more but, without sales to fulfill, there’s no point it doing so.

Because (in this scenario) sales determines the profitability of the organization as a whole, we can draw some conclusions about how sales and production should work together:

- Sales should sell as much as possible (in this scenario, it does make sense for sales to sell as much as possible)

- Production should produce whatever sales sells (and nothing more)

We can now generalize from these conclusions to arrive at two simple rules – applicable to every business:

- The constraint should operate at full capacity, at all times

- Non-constraints, should subordinate to the constraint (in this context, subordinate means keep up with)

It should now be clear that sales should only operate at full capacity (i.e. sell as much as possible) when it is the constraint. In all other scenarios, sales should subordinate to the constraint.

So, if we reverse the capacities of the functions in our simple business (meaning that production is now the constraint), we can conclude that:

- Sales should sell only what production has the capacity to produce

- Production should operate at full capacity, at all times

Variability (our dark passenger)

Actually, these two rules will not produce the optimal outcome in reality! And, when we understand the reason why, we’ll also understand why our organization should have a (single) constraint in the first instance.

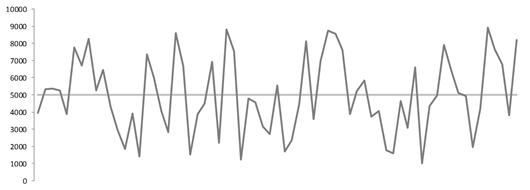

We must acknowledge that, in reality, the output of any resource is inherently variable. When we talk about a person, a machine or a plant producing an output of x, what we really mean is that the output averages x. If we plot the output of that resource (any resource) on a run-chart, we will discover that its output is quite variable.

This inside (telephone-based) salesperson may average

$5,000 in sales a day, but her range is greater than her mean.

This means that (continuing with our example above) it is impractical for sales to aim to provide production with $T10,000 worth of orders a day, for two reasons:

- The output of sales will vary dramatically (as is the nature of sales) from day-to-day

- The capacity of production will also vary but it’s variability will be independent of – and, therefore, out of sync with – that of sales

If sales was to attempt to provide production with $T10,000 worth of orders a day, production will find that it is regularly starved of work – meaning that the actual output of the organization will be less than the capacity of production (the constraint).

The solution to this problem requires that sales maintains a buffer of orders upstream from production, large enough to absorb the sales function’s inherent variability (but no larger).

The existence of the buffer enables the organization to fully exploit its production capacity, as well as to maintain good on-time delivery performance. However, if the buffer is larger than necessary, it will increase delivery lead-time – causing the organization’s product to be less appealing to customers.

With this small (but critical) modification to our simple business, we can now finalize our directives to each function:

- Sales should maintain the constraint buffer at its optimal size

- Production should operate at full capacity, at all times

As promised, variability also points us to the reason why an organization should have a (single) constraint.

The inherent variability in the output of every resource means that an attempt to balance the capacities of resources is a fool’s errand. In an environment where all resources have identical average capacities, the day-to-day variation in actual output will result in the emergence of a constraint that wanders, unpredictability, from resource to resource – rendering the organization unmanageable.

It makes more sense for management to determine which function should be the constraint and then build enough protective capacity at non-constraint resources to ensure that the system is stable.

The optimal constraint location

That’s right; you get to choose the location of the constraint within your organization. (Well, you do if – and only if – you can stop the cost accountants from attempting to balance the capacity of all resources!)

To shed some light on this decision, let’s meet one of our silent revolutionaries prior to their transition.

Acme is a traditional (plate and ink) printer. Its owner has stayed current with technology and has, consequently, seen Acme’s production capacity increase geometrically over the last 15 years. The owner’s not-insignificant investment in technology has produced a dramatic improvement in plant efficiency, measured on a per-impression (or, printed-page) basis.

However, Acme’s sales team has failed to keep-up with production. The plant has the capacity to generate around $600,000 a month in Throughput, but the sales team is selling less than a third of that. The owner is rapidly realizing that the efficiencies produced by the new technology are a mirage if the additional capacity is not sold.

Clearly, in Acme’s case, sales is the system constraint, meaning that we can apply our two rules to define objectives for both sales and production. But advising sales to sell as much as possible – and production to keep pace – is not much of a solution when two-thirds of acme’s plant capacity is sitting unused.

It makes more sense to take pause and examine the overall design of the organization. And, in so doing, the very first question we should ask is: which function should be the organizational constraint?

To answer that question, we must start at the beginning: with the goal of the organization.

We know that Acme’s goal is to make money but it’s worth exploring what make money really means. Clearly it means more than generating revenues (you can generate a lot of revenue and still go broke). It must also mean more than making profits (profits are good, but they are only half of the story). That’s right; making money means maximizing the return on owners’ equity (and you can do this by increasing the return, decreasing the equity or some combination of the two).

This better understanding of the goal helps us to recognize that production should probably be Acme’s constraint (not sales). The reason is that production is where almost all of the owner’s equity is invested!

So, in the short run, our two rules may provide Acme with a thumb in the leaking dike, but in the long run, Acme must:

- Dramatically increase the capacity of the sales function (until sales can consistently sell more than production has the capacity to produce)

- Reduce the capacity of the plant

Once Acme has remedied this immediate problem – and shifted the constraint to production – then the responsibility of sales will no longer be to sell as much as possible. Sales will be responsible for maintaining a queue of orders up-stream from production – large enough to ensure that production operates at full capacity, day in and day out.

Because Acme is one of our silent revolutionaries, you can probably guess that they chose to dramatically increase the capacity of sales. Today, the presses at Acme run at 100% utilization, 100% of the time. Acme’s salespeople are no longer looking for something – anything! – to print. Instead, they search constantly for ways to increase the yield that Acme earns on its finite plant capacity.

The third function: new product development

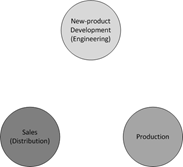

Now that we understand the concept of the constraint, we need a more complete model of the organization. To date we’ve envisaged just two functions, sales and production.

In the long-run, however, a business needs (at least) one more function in order to thrive: new-product development (or engineering).

The primary responsibility of new-product development (NPD) is to conceptualize and design the products (or services) that sales sells and that production delivers. (Additionally, NPD will often innovate internally, creating better production or distribution processes.)

It’s critical that we explicitly recognize the existence of – and the importance of – NPD . It’s not just that NPD keeps the organization relevant in the long-run. In most organizations it’s NPD that determines whether or not potential customers are prepared to entertain your salespeople!

Now, obviously all organizations have more functions than those examined here (finance, administration, etc) but, because these are support functions they have no bearing on this discussion. Similarly, I am choosing to ignore senior management because I’m assuming that it’s senior management who’s doing the modeling in the first place!

With our model expanded to three functions, determining the ideal constraint location becomes a little trickier. However, if we consider the three value-chain configurations we discussed in Chapter 2, the optimal constraint location starts to come into focus.

Make to stock

A traditional car company (e.g. Ford or Toyota) is an example of a make-to-stock (MTS) manufacturer. The flow is simple:

- NPD designs something

- Production manufacturers it

- Sales sells it

In most cases, MTS manufacturers sell via arms-length resellers, rather than direct – and for this reason, it makes more sense to refer to our third function as distribution than sales. In practice, this does not make a large difference – particularly when you consider that the manufacturer will still need to maintain some kind of salesforce in order to acquire and develop channel relationships.

As for the question of which function should be the organization’s constraint, this is evident from the phrase make to stock. As discussed previously, the stockpile of inventory exists to buffer production from distribution – meaning that sales must be the constraint.

In most cases the flow between NPD and sales is asynchronous (hence the dotted line above). In other words, NPD designs new products periodically, not once for each item manufactured.

Because services cannot be stockpiled, the term MTS applies purely to manufacturers.

Make to order

Production does not commence for a make-to-order provider until the order is received. Accordingly, there can be no inventory of finished goods.

Increasingly, technology is allowing even traditional manufacturers (think, car companies) to move to a make-to-order (MTO) configuration. Dell is a perfect example of a MTO manufacturer – as is a tax agent or a traditional printer. A MTO provider does not have to design a new product for each client – rather it’s a case of configuring standard options to suit the client’s specifications.

The MTO flow looks like this:

- NPD designs a product (or service) with a finite number of customizable options

- Sales sells the product – and helps the client customize it to suit their requirements

- Production produces it

In most cases, the ideal constraint location for a MTO producer will be production. The responsibility of sales (as per our Acme example) should be to maintain a queue of orders upstream from production. Furthermore, this queue of orders should ideally be composed so as to maximize the yield on production’s limited capacity (bearing in mind that different mixes of work will have varying impact on the profitability of the organization).

An interesting example of an MTO provider is a funeral home. At first glance, it would appear impossible for a funeral home to maintain a queue of orders upstream from production (the mortuary). The reality, however, is that, in recent years, funeral homes have figured-out how to do exactly this! Most homes today have sales teams that sell funeral plans – meaning that, when a person passes, their funeral has already been arranged and paid for.

Engineer to order

Engineer to order (ETO) environments add another level of complexity to MTO.

Rather than configuring a product (or service) to suit a customer’s requirements, an ETO provider designs a custom solution and, in most cases, the design procedure spans the point of sale. In other words, in an ETO environment, the vendor will most likely need to do some preliminary design to win the job and will then have to complete the design after the job is won.

In most ETO environments, engineering should be maintained as the organizational constraint. This is because:

- Engineering is the source of the firm’s competitive advantage

- Engineering is, in most cases, harder to scale than sales or production (remembering that components of production can generally be out-sourced)

Examples of ETO providers include engineering and architecture firms, traditional- and web-design companies, and enterprise-software providers.

A new objective for sales

If we adjust our diagram to indicate the optimal constraint location for each value-chain configuration, we now have our final model. In each case, the constraint is the resource downstream from the constraint buffer.

In summary then, what we are proposing is that:

- In each case, the constrained function (and only the constrained function) operates at 100% utilization.

- Non-constrained functions subordinate to the constraint

For each resource, to subordinate means something a little different:

- NPD subordinates (in MTS and MTO environments) by ensuring that product (or service) offerings are consistently appealing to the market (meaning that they are innovative and that they can be competitively priced)

- Production subordinates to distribution in a MTS environment by ensuring that inventory stockpiles are the optimal size (and composition). Too little inventory will mean stock-outs and too much will cause distribution to liquidate unsold items or, alternatively, will prevent the uptake of newer lines.

- Sales subordinates in MTO and ETO environments by ensuring that a queue of orders is maintained up-stream from either production or engineering – and by ensuring that the composition of this queue maximizes the yield on the downstream function’s finite capacity

We can now see that it’s only in the case of the MTS environment that the objective of sales should be to sell as much as possible.In the other two environments, sales should be subordinating to either production or engineering.

And, as we mentioned earlier, over time, organizations are tending to transition from MTS to either MTO or ETO. This means that it is increasingly unlikely that your sales function is (or at least should be) the organizational constraint.

If you are not a MTS manufacturer and your sales manager believes that their responsibility is to maximize sales then you should suspect that this is evidence of an organizational design problem. If it does not make sense for sales to be your organizational constraint then sales should have enough protective capacity to enable it to maintain a queue of orders upstream from either production or engineering at all times (come hell or high water).

If sales is resourced properly, your sales manager would never claim that it’s their responsibility to maximize sales. It would be obvious to them that this would cause the order queue to quickly inflate to the point where lead-times would explode and client relationships would be damaged. (If you consider that the sales function exhibits a greater degree of variability than all other functions, it should be clear that you need quite a deal of protective capacity in sales to enable that function to subordinate effectively).

As mentioned, it’s not just the size of the order queue that’s important in MTO and ETO environments: it’s the composition of that queue. Sales should be responsible for selling the mix of work that maximizes the yield on either production’s or engineering’s finite resources.

The optimal mix

Now, the notion of constraints applies at the functional – as well as the organizational – level. In other words, if your organizational constraint is your production function, then the production function will be constrained (at any one point in time) by a single production resource.

In Acme’s case, production is now the organizational constraint. However, if we look inside production, we discover that the plant is designed to ensure that a bank of shiny new 5-color Heidelbergs operates at 100% capacity at all times. The other production resources subordinate to that that bank of printing presses.

If Acme’s sales manager wants to maximize the profitably of Acme (which I can assure you he does), he will plan promotional and sales activities with a view to (in this order):

- Keeping those printing presses fully loaded with work

- Prioritizing jobs that maximize the yield on the Heidlebergs’ limited capacity

- Identifying opportunities to sell any spare capacity in the plant that may not put a load on the presses (e.g. it might be possible to opportunistically sell some spare capacity in the bindery to a print broker)

It should be clear that this tight integration of sales and production will have a profound impact on the profitability of the firm (as indeed it has in Acme’s case).

And the importance of tight integration (as discussed in the previous chapter) is even more critical in an ETO environment, where the line between sales and production is blurred.

For this reason, in MTO and ETO environments, the new approach to the design of the sales function, presented in this book, offers much more than the opportunity to build a more efficient sales function. By allowing the tight integration of sales with other functions, this new model will impact almost every facet of the client engagement.

A word of caution

The model presented in this chapter is intended as a ready-reckoner – not as a substitute for a formal approach to strategy formulation.

As well as the value-chain configuration, you should also consider the source of the organization’s competitive advantage. For example, if movie studios and drug companies compete on the basis of continual and rapid innovation, NPD (or R&D) should always be their organizational constraint (remembering that the constraint is the only function that operates at 100% utilization).

And, as suggested earlier, it’s worth paying attention to how owner’s equity is distributed among functions.

In the case of organizations that consist of a single function (print brokers and travel agencies, for example), the identification of the optimal organizational constraint should be relatively easy!